US housing data aggregator CoreLogic is now offering a short sale fraud detection tool that monitors the property even after the sale is completed.

Nearly two weeks ago, CoreLogic announced that short sales has cost lenders nearly 300 Million in 2010.

“Today lenders, to a higher point than ever before, are dealing with foreclosure and dealing with borrowers,” said VP of Fraud Solutions at CoreLogic, Frank McKenna, “and with an estimated 400,000 short sales to be negotiated with real estate agents, there needed to be a way to make sure all offers on a property are disclosed.”

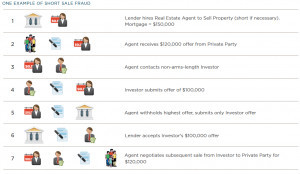

The new service allows lenders to receive alerts on potentially risky lending and even closed short sale transactions to minimize unnecessary losses related to fraud and property underpricing, an example of which is in the below graph:

McKenna said the risk of this flopping fraud – giving a low ball offer, closing, then selling again at a higher price – is becoming so pervasive that some lenders are considering putting in place requirements to prevent property resales for 90 days after closing.

The new CoreLogic Short Sale Monitoring Solution alerts lenders whenever a higher bid is made, but not necessarily disclosed by an agent. Once the short sale is closed, the monitor still keeps tabs to report any bids for resale.

Freddie Mac reported that it has seen short payoff volume grow more than 1,000 percent, and that the upward trend in volume leaves the market ripe for incidences of short sale payoff fraud.