A Historic First Changes Everything

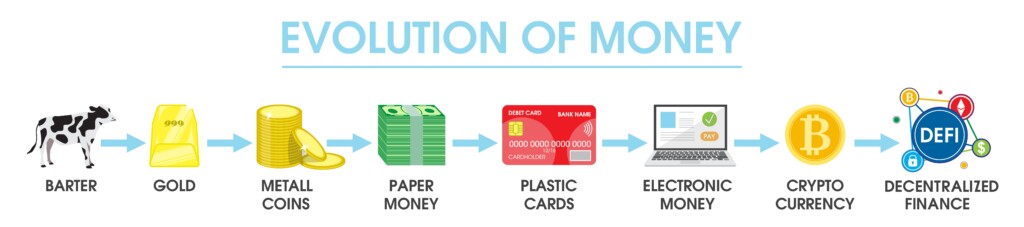

The real estate industry just got its most significant technological catalyst in decades. Kore has achieved something that seemed impossible just months ago: complete interoperability between public blockchains like Ethereum and full regulatory compliance with U.S. securities laws. For the first time ever, investors can hold regulated securities tokens directly in standard crypto wallets while maintaining 100% compliance with SEC, FINRA, and other regulatory requirements.

This breakthrough represents far more than a technical achievement—it’s the missing piece that could finally unlock widespread cryptocurrency adoption in residential real estate transactions. With experts predicting tokenization could handle 20% of real estate deals by 2025, and over 94% of cryptocurrency users being millennials and Gen Z who are also major participants in the first-time homebuyer market, the timing couldn’t be more critical.

The Early Adopter Who Saw the Future

The Early Adopter Who Saw the Future

Real estate mogul Grant Cardone has been quietly positioning himself at the forefront of this transformation. Managing over $5 billion in real estate assets through Cardone Capital, Cardone has become one of the most vocal proponents of blockchain’s potential to revolutionize property transactions. “I am very excited about the potential of real estate tokenization to democratize access to Real Estate investing by allowing fractional ownership,” Cardone stated, emphasizing how this approach could give a broader range of people the chance to invest in real estate.

Cardone’s commitment to crypto real estate goes beyond mere advocacy. He recently listed a massive, luxurious property for sale on Propy’s blockchain-based real estate platform. The private property in Golden Beach, Florida, USA, has an asking price of $42,000,000, accepting Bitcoin payments and showcasing the practical application of cryptocurrency in high-value real estate transactions.

But Cardone’s most innovative move may be his hybrid investment strategy. Grant Cardone has introduced a new $88 million fund that mixes real estate and bitcoin. The property’s cash flow is used to buy even more bitcoin. This groundbreaking approach demonstrates how established real estate investors are integrating cryptocurrency into their core business models, not as a side venture, but as a fundamental strategy.

The Regulatory Hurdle That’s Been Holding Everything Back

Until now, one of the biggest obstacles preventing mainstream crypto adoption in real estate has been the regulatory compliance gap. The SEC’s 2025 guidance emphasizes that if token buyers expect profits based primarily on the efforts of a centralized team or promoter, the token is likely a security. This classification triggers extensive compliance requirements that have made seamless crypto real estate transactions nearly impossible.

However, he also acknowledged that this disruption may be unsettling for regulators and traditional real estate firms. Cardone has been particularly vocal about regulatory challenges, noting that the SEC is “dragging its feet” on providing clear frameworks for real estate tokenization.

The challenge has been particularly acute for real estate tokenization. Real estate tokenization market will surge from $3.5 billion in 2024 to $19.4 billion by 2033, with a remarkable 21% yearly growth. Yet despite this explosive growth potential, once the SEC determines a cryptocurrency or token is a security and falls under its regulatory purview, this has far-reaching implications. The issuer must then follow SEC regulations that come with extensive reporting and transparency requirements.

How KoreOracle Solves the Impossible Problem

![]() Kore’s KoreOracle infrastructure represents a paradigm shift by acting as what they call a “compliance bridge.” Instead of forcing users into proprietary custodial systems or complex off-chain workarounds, KoreOracle enables real-time validation, transaction monitoring, and lifecycle enforcement for all tokenized securities directly on public blockchains.

Kore’s KoreOracle infrastructure represents a paradigm shift by acting as what they call a “compliance bridge.” Instead of forcing users into proprietary custodial systems or complex off-chain workarounds, KoreOracle enables real-time validation, transaction monitoring, and lifecycle enforcement for all tokenized securities directly on public blockchains.

This breakthrough directly addresses the regulatory concerns that have kept industry leaders like Cardone cautious. For someone managing billions in real estate assets, regulatory compliance isn’t optional—it’s existential. KoreOracle’s achievement means that for the first time, a homebuyer could potentially:

- Hold tokenized real estate securities in their standard MetaMask or Coinbase wallet

- Execute transactions on Ethereum while maintaining full SEC Transfer Agent compliance

- Trade on secondary markets under proper FINRA oversight

- Participate in Alternative Trading System (ATS) transactions seamlessly

The implications are staggering. Traditional real estate transactions involve multiple parties, paperwork, and prolonged waiting periods. With cryptocurrency: Payments can be settled instantly, reducing closing times from weeks to minutes.

Real Estate’s Trillion-Dollar Transformation

The real estate industry is already experiencing crypto adoption at unprecedented levels. By January 2025, the total market capitalization of cryptocurrencies surpassed $3.5 trillion, with Bitcoin hitting an all-time high of $109,100. More importantly, stablecoins now account for over 91% of daily market volume, providing the stability needed for large real estate transactions.

The demand is clearly there. Cryptocurrency transactions typically cost around 1% or less, providing a cost-effective alternative for buyers and sellers, compared to traditional payment methods that often involve fees ranging from 2-5% for international wire transfers. For a $500,000 home purchase, this represents savings of $10,000 to $20,000 in transaction costs alone.

Cardone’s recent actions demonstrate this demand in practice. Grant Cardone announced that his company plans to buy up to 3,000 more Bitcoin, further strengthening its crypto holdings. As of now, Cardone Capital’s Bitcoin holdings are valued at over $100 million, showing institutional-level commitment to cryptocurrency integration.

The Cardone Model: Cash Flow Meets Crypto

What makes Cardone’s approach particularly compelling is how it bridges traditional real estate investment with cryptocurrency innovation. “Nobody else has ever done this to scale. Nobody’s ever done this particular model,” Cardone told CoinDesk in an interview. “And the response from our investors is phenomenal.”

His strategy is elegantly simple: use real estate cash flow to systematically accumulate Bitcoin. Cardone plans to buy bitcoin in a price-agnostic way — meaning that he won’t be focused on buying dips, but will simply purchase bitcoin within 72 hours of the monthly distributions coming in. This approach provides crypto exposure without sacrificing the income-producing capabilities of real estate.

And his ambition is to roll out 10 other such projects before June, for a grand total investment of $1 billion. This scale of institutional adoption signals that crypto real estate integration is moving from experimental to mainstream.

The Regulatory Tailwinds Are Strengthening

The regulatory environment is becoming increasingly favorable for this transformation. The introduction of the new Crypto Task Force by SEC Acting Chairman Mark T. Uyeda is a welcome move. Under the leadership of Commissioner Hester Peirce, who took a pro-crypto stance even during the previous administration, the new task force represents a departure from the SEC’s previous “regulation-by-enforcement” strategy.

The task force aims to provide regulatory clarity while promoting investor protection and crypto innovation. This shift from enforcement-first to collaboration-first regulation creates the perfect environment for innovations like KoreOracle to flourish.

For established players like Cardone, this regulatory clarity is crucial. Commenting on the Propy listing, Cardone remarked that “we are all in on blockchain revolutionizing real estate. We are leveraging top-tier technology to make transactions seamless and unstoppable. This is the future of real estate,” he said.

What This Means for Homebuyers and Sellers

The practical implications of fully compliant crypto real estate transactions extend far beyond just faster payments:

For International Buyers: Cross-border transactions are seamless, avoiding currency exchange fees and delays. Crypto allows investors from different parts of the world to participate in real estate markets that were previously inaccessible.

For Liquidity: Traditionally, real estate is considered an illiquid asset. Crypto and tokenization change this dynamic by enabling investors to sell fractional shares of properties at any time.

For Accessibility: Real estate tokenization enables fractional ownership, meaning investors could own portions of multiple properties rather than being locked into single, large investments.

For Security: The transparency and tamper-proof nature of blockchain ensures secure, unalterable transaction records, crucial in real estate where large sums are involved.

The Network Effects Are Just Beginning

What makes Kore’s breakthrough particularly significant is its potential to create powerful network effects. As more real estate transactions become tokenized and compliant, the infrastructure becomes more valuable for everyone involved—buyers, sellers, brokers, lenders, and regulators.

Large financial institutions and real estate firms are beginning to explore blockchain technology, which could lead to increased mainstream adoption. With a fully compliant infrastructure now available, we can expect this exploration to accelerate dramatically.

The ripple effects could extend into related areas:

- Crypto-backed mortgages: Borrowers can use crypto assets as collateral to secure loans for property purchases. DeFi lending platforms offer lower interest rates, flexible terms, and fewer credit restrictions than traditional banks

- Smart contracts for escrow: Smart contracts automate escrow services, ensuring funds are released only when predefined conditions are met

- Blockchain-based title management: Governments and private entities are experimenting with blockchain-based land registries, reducing fraud and improving property title management

Learning from the Pioneer

Cardone’s early adoption provides valuable insights for what mainstream crypto real estate adoption might look like. His hybrid approach—maintaining traditional real estate income while systematically building crypto exposure—offers a template that other real estate investors and homeowners could follow.

“The place I’m at in my life, I can take this chance. I don’t need more cash flow,” Cardone said. “But if you’re 25 years old and you’re trying to get some cash flow for life, bitcoin is not a solution. It’s a bet, it’s a gamble, and you got to pay rent, you got to take care of your family, you got to pay your bills.

This perspective highlights the importance of KoreOracle’s compliance breakthrough. By making crypto real estate transactions fully regulatory compliant, it transforms cryptocurrency from a speculative bet into a legitimate financial tool that can be integrated into traditional investment strategies.

Challenges and Considerations

Despite this breakthrough, several challenges remain:

Market Education: Many property sellers still prefer fiat transactions due to familiarity and stability. Real estate professionals need education on blockchain and cryptocurrency to facilitate adoption.

Volatility Concerns: While stablecoins address much of this concern, price volatility remains a consideration for both buyers and sellers.

Regulatory Evolution: Cryptocurrency regulations vary significantly across countries, which can impact real estate transactions.

The Investment Thesis

For investors, real estate professionals, and technology companies, Kore’s achievement represents a watershed moment. The combination of regulatory compliance and technical capability creates what may be a narrow window of first-mover advantage.

Cardone’s success provides a proof of concept. The decision by Cardone Capital is consistent with a larger trend in institutional space where large companies are becoming more likely to use Bitcoin. Companies like MicroStrategy, Tesla, and Galaxy Digital are other leading companies that have taken major Bitcoin investments.

Cryptocurrency is set to revolutionize investment property purchases by increasing accessibility, efficiency, and liquidity. While challenges such as regulatory uncertainty and market volatility exist, the adoption of blockchain technology in real estate is inevitable.

Looking Forward: The New Reality of Real Estate

Kore’s breakthrough, combined with institutional adoption by leaders like Cardone, suggests we’re entering a new phase where the friction between innovation and regulation dissolves. Instead of crypto companies trying to work around regulations, or regulators trying to constrain innovation, we now have a model where both can coexist and reinforce each other.

“Blockchain transactions are a game-changer for residential and commercial real estate,” he said, noting that the technology can potentially disrupt the industry. Cardone’s prediction is becoming reality.

This could be the beginning of a fundamental shift in how Americans think about homeownership, investment, and financial sovereignty. When buying a home becomes as simple as a crypto wallet transaction, while maintaining full regulatory protection, we’ll likely see participation from demographics and geographies that were previously excluded from real estate investment.

The infrastructure is now in place. The regulatory clarity is emerging. The market demand is proven through early adopters like Cardone. What happens next will likely reshape not just real estate, but the broader relationship between traditional finance and decentralized technology.

As Cardone put it when listing his $42 million property on blockchain: “This is the future of real estate.” With KoreOracle making that future fully compliant, the transformation is no longer a question of if, but when.

WAV Group holds no financial interest in Kore, Grant Cardone entities, or related crypto assets. This analysis is based on publicly available information and should not be considered investment advice.