Many MLSs have tried to show the value of their marketplace by comparing the price performance of homes sold inside the system against those sold outside it. The instinct is right. The execution often isn’t.

The issue isn’t motive, it’s method. When WAV Group reviews the raw data behind these analyses, a pattern shows up every time. MLSs are grouping all off MLS transactions together without looking at why those sales never reached the open market. That oversight produces conclusions that sound authoritative but rest on the wrong foundation.

What off MLS data really contains

Off MLS sales are overwhelmingly not private exclusives or pocket listings. They’re family transfers. They’re inheritances. They’re transactions between people with existing relationships who were never going to list the home publicly.

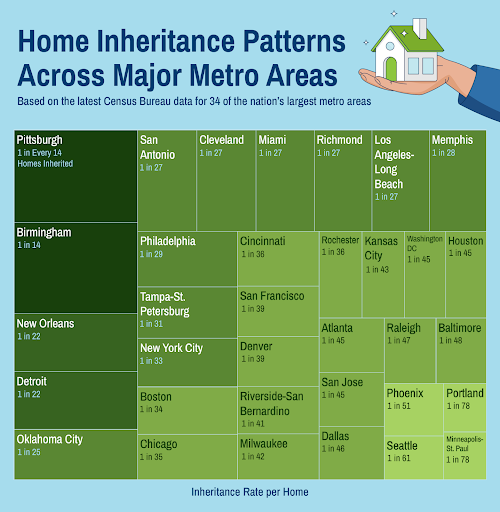

Coventry Direct’s national analysis of inheritance patterns highlights the scale of this phenomenon. Their study shows that between 2% and 5% of all real estate transactions in many parts of the country involve inherited homes. When you translate that into the population of off MLS transfers, inheritance activity often represents close to three quarters of the off market category.

This matters. Inherited properties often transfer at below-market values, especially when siblings buy out each other’s shares or when an estate settles a property without marketing it. Using those transfers in a price comparison against listed properties will inevitably show MLS listings outperforming off MLS sales. The numbers aren’t wrong. The interpretation is.

There is a great report about this from Coventry Direct – you can read it here.

Pay Close Attention

When you look at the rates, you see that in San Francisco, one in 39 homes are inherited. Pittsburgh is one in 14. This is not shadow inventory, its family transfer of wealth.

Why MLSs keep getting this wrong

Most MLSs don’t have deep experience in probate, estate settlements, or the nuances of interfamily property transfers. They assume “off-MLS” means “a broker chose not to list this home.” In reality, most of these homes were never candidates for listing. Comparing them to arms-length, agent-represented, publicly marketed sales is a category error.

The industry is also living through a historic generational shift. The Greatest Generation and the Silent Generation are transferring millions of homes to their children. Much of that volume never touches the MLS, and it distorts any attempt to use off-MLS comparisons as a policy benchmark or competitive argument.

What MLSs should be doing

A stronger methodology would segment off MLS data into three buckets:

- interfamily transfers

- inherited or estate sales

- broker-enabled private exclusives or non-MLS trades

Only the third category is appropriate for performance comparison. The first two should be acknowledged, quantified, and removed.

MLSs that want to defend their market impact have a strong case. They just need to use the right data set. Once the categories are clean, the value story becomes even clearer because you’re comparing homes that were truly exposed to the market against homes that were intentionally marketed only to a smaller audience.

If you MLS would like to collaborate on an off-MLS study, please contact us below and we can help you get the methodology right.