Graphs, Actives, Pendings, Recently sold, yadda, yadda. I have been reviewing the market reports across a variety of brokerages recently. They all seem to be missing the same little touch of information – an AVM.

Graphs, Actives, Pendings, Recently sold, yadda, yadda. I have been reviewing the market reports across a variety of brokerages recently. They all seem to be missing the same little touch of information – an AVM.

What Is A Market Report?

The definition of a market report is hard to pin down. They are automated reports that tend to change based upon the state of the consumer. If the consumer is actively looking to buy or sell, the market report is like a listing alert. If the consumer is not in the market, the market report is like a stock portfolio summary.

Why Brokers Need to Deploy AVMs

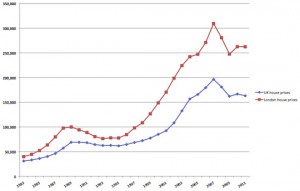

Automated Valuation Modeling, or AVMs were developed to help banks measure their loan portfolio. You put hundreds of thousands of homes into a mathematical equation and it spits out estimated home values. These AVMs are considered excellent when they come within 5% of the value of a home 90% of the time. In other words, the best they can do is get close enough for horseshoes.

Perhaps you may have had experience with AVMs on a consumer site called Zillow®. Their AVM is the Zestimate™. When Zillow launched their Zestimate, they crashed their servers. Consumers were so excited that they overwhelmed the young start up. They replaced a lead form on broker and agent websites. That was in 2006, nearly a decade ago. Today, only a scarce few number of brokers have Zestimates on their website.

AVM Best Practice

The industry hates Zestimates because pricing a home is sacred ground. Even if the Zestimate were perfectly correct every time, the industry would still hate it. Its time to get over it and introduce AVMs into all of your consumer facing products.

Don’t deploy AVMs with one solution. You know and I know that they are only horseshoe accurate, so show that to the consumer. When you deploy AVMs, put two or three of AVM solutions on the property. Fox and Roach launched this solution last month. When you show more than one, the consumer recognizes the margin of error for each solution. It invites a conversation with the consumer about what AVMs are, how they work, the range of error, and most importantly – pricing strategies. AVMs will actually set the REALTOR® up for the conversation that they need to have with every buyer or seller. Be sure to tell them that mortgage lenders depend on AVMs.

AVM Service Providers

Zillow has an API to display the Zestimate called GetZestimate™, it’s free and you get to use their brand. Visit Zillow: http://www.zillow.com/howto/api/GetZestimate.htm

The NAR RPR has two AVMs. The REALTOR Valuation Model™ or RVM cannot be displayed to the public. But they also have a secondary AVM produced by Black Knight Financial for RPR that brokers may display (only brokers). Contact your local RPR rep or visit their website at narrpr.com for live chat and 24-7 telephone support.

Collateral Analytics – This company was among the first AVM providers to base their models on active listing data. Brokers in their partner network may license a consumer AVM. Call Kathy King.

CoreLogic AgentAchieve – Corelogic® is the largest provider of AVM solution to GSEs, Banking and the capital markets. They have a number of AVMs available. The broker solution is called ePropertyWatch. Call Scott Mullen.