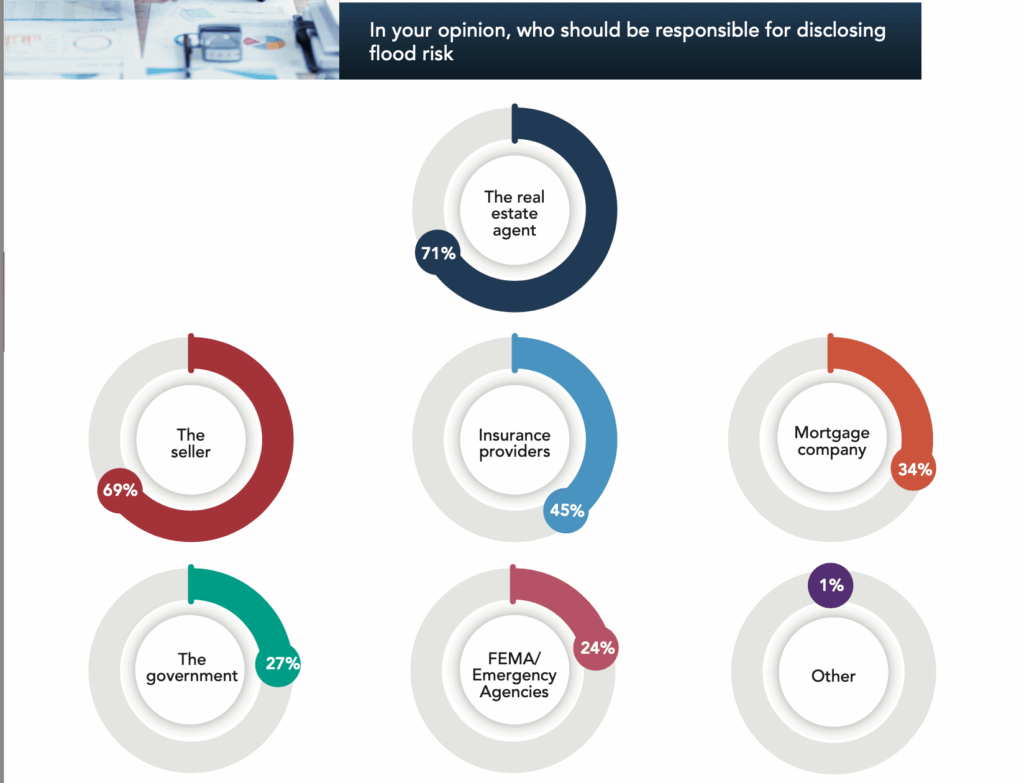

Most homeowners believe it’s their real estate agent’s job to point out flood risk. That’s not just compliance—it’s about being a reliable, trustworthy guide. Floods are also far from rare, and when they happen, the damage is staggering. The National Flood Insurance Program, a public–private partnership with government agencies, homeowners, and insurers, currently protects about $1.3 trillion in assets nationwide. In 2024 alone, there were 86,000 claims with payouts totaling $5.4 billion.

Rising insurance premiums and coverage changes are putting flood risk in the spotlight. Flood damage often isn’t covered by standard homeowners insurance, which makes consumer awareness even more critical. Buyers are increasingly asking not just if a property is in a flood zone, but what that means for their long-term costs and protection.

Our 2025 WAV Group Natural Disaster Homeowner Sentiment Survey makes it clear that the expectation falls squarely on agents. When homeowners were asked who should disclose flood risk, real estate agents came out on top—well ahead of inspectors, appraisers, or local governments.

The challenge is that agents can’t meet this expectation without the right tools and support. MLSs and brokers can help by integrating flood risk data into listings, offering training on interpreting FEMA maps, and providing clear disclosure templates that agents can use with confidence.

It’s not just about checking a box. Helping agents meet this expectation strengthens credibility, reduces risk, and shows clients you’re on top of what matters most.

Get the full report

The 2025 WAV Group Natural Disaster Homeowner Sentiment Survey is packed with actionable insights for MLSs, brokers, and agents.