My wife woke up this morning to the voice of Alec Baldwin telling her “Wake up Sunshine. Let me tell you something, I’ve been up since the crack of dawn…” before I shout out “off” and silence Alec in midsentence. No, Alec isn’t in our bedroom. Alec’s voice is an alarm option in Alexa, our household’s digital assistant that’s built into both our Amazon Echo and Dot. It’s simply the coolest – and most practical – innovation I’ve seen in decades.

My wife woke up this morning to the voice of Alec Baldwin telling her “Wake up Sunshine. Let me tell you something, I’ve been up since the crack of dawn…” before I shout out “off” and silence Alec in midsentence. No, Alec isn’t in our bedroom. Alec’s voice is an alarm option in Alexa, our household’s digital assistant that’s built into both our Amazon Echo and Dot. It’s simply the coolest – and most practical – innovation I’ve seen in decades.

Alexa is a vibrant example of the rampant innovation emerging today. Life-changing stuff: self-driving cars, VR immersion technology, drones, nanobots, sensors, and the Internet of so many more “things.” But innovation requires risk for fuel. So for much of the last decade – with the exception of a handful of companies that were cash flush – innovation was stymied. That’s because hardly anyone could afford to take risks. We were too busy making sure we could just put food on the table, so to speak. After all, baby’s got to eat.

Risk taker, rule breaker

An exception was Amazon, one of the world’s greatest risk-taking firms. Alphabet (Google) and Apple are two others, but what is so powerful about Amazon is how its very culture embraces the reality that innovation is most often the result of massive failure.

Just listen to what Amazon’s founder, Jeff Bezos, said about 18 months ago: “A few big successes compensate for dozens and dozens of things that didn’t work.” Kindle tablet = $$. Amazon’s third-party marketplace = $$$. Amazon’s data center business = $$$$$. And he added this: “Bold bets…pay for a lot of failures. I’ve made billions of dollars of failures at Amazon.com.” Think Fire Phone, hotel-booking site Amazon Destinations, and Amazon Auction, which was designed to compete with eBay, among dozens of others.

Innovation is expensive, but the payback can be astounding: the combined current market value of the triple-A – Amazon, Alphabet and Apple – is currently more than $1.32 trillion dollars. Think about it: that’s a greater market value of nearly 10 IBMs or 28 General Motors. Two of these companies are less than 25 years old.

Economy enables risks, spawns innovation

Pull up a chart of VC funding over the last 25 years and put that against some of the most groundbreaking innovations, and you are likely to come to the conclusion that it takes money to empower innovation. When VC funding is flush, innovation breakthroughs are bigger and better. When VC funding is sparse, major innovation breakthroughs are more scare. But I would argue that money isn’t the direct driver of innovation, rather money empowers risk-taking, which again, is the real fuel for innovation.

It’s happening in real estate

For the first Real Estate Connect in San Francisco, June 1997, the headline I wrote for a news release to promote the Inman News conference said, “Do you really want to apply for a home loan in your underwear?” It touted the emergence of online lending. Brad Inman’s timing has proved impeccable over the years and innovation in real estate and the promise of a paperless transaction was rampant until we all blew a gasket, as Internet 1.0 came crashing in 2000.

There was a lot of blood in the streets: Broadcast.com sold for $5.9 billion to Yahoo!, who also spent $3.47 billion on GeoCities – both websites are now gone. Infospace, which hit $1,305 a share in 2000, collapsed to $22 a share a year later. Lycos sold for $12.5 billion in 2000 and was resold for $95 million four years later. And you thought only real estate gets hit!

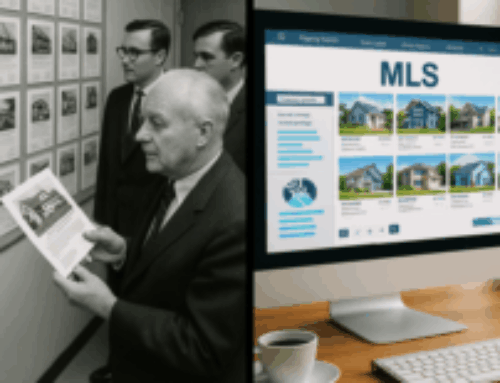

But leading up to the big bubble was massive innovation. What we called disintermediation then, we now call disruption, but the biggest takeaway is to look at the rampant innovation we are seeing in real estate today.

Most importantly, risk-taking is back in real estate. Many will fail and a few will succeed, if you buy into the Bezos’ school of thinking. But how exciting it is to witness all that is happen: the mobile revolution, marketing automation, processes being reimagined and business models being turned upside down or shredded.

Big changes are inevitable

The world’s biggest real estate brand – Zillow – is an advertising outlet and the industry’s most coveted website – realtor.com – is owned by an Australian-born media mogul. Who would have guessed that 10 years ago? But then again, who would have guessed that AOL would become irrelevant and the once unstoppable Homestore would disappear?

Big change is coming because we are taking risks once again: The bigger the risks, the more likely we are to create something, like Alexa, that is life-changing.

Today, real estate industry buzzwords are all linked to innovation: Upstream, AMP, RESO and the Broker Public Portal, to name just a few buzzwords, are all connected. The people who actually sell homes also are enabling these efforts for the first time. They are attempting to control their own future and they are doing it by taking risks – big risks.

Will there be massive failures? Most certainly. Will there be life-changing innovation that alters how we see real estate today? I believe there will. I know I am excited to watch the promises of 1997 leap faster towards becoming a reality.