For mobile apps, it’s the Apple App Store or Google Play Store. But where is the app store for everything else? Where is Amazon for real estate tech? There are many oars in the water, but there is no clear leader in the race.

In the franchise space…

According to Keller Williams – their agents are purchasing between $750 Million and $1 Billion of technology products every year. That is around $350 per month per agent or more using their estimated agent count of 170,000. That feels like a lot more money per month than I would expect. I am sure that Keller Williams wants that revenue going through them either as purchases of technology they build and sell, or apps that they resell for tech firms.

Realogy is taking a run at the app store too. They started the app store journey in 2014 with the acquisition of Zip Realty. Today, the Realogy App store strategy is tied to Zap, and powers technology for about 150,000 real estate agents that are connected to Realogy. Their focus has been on developing a CRM with a cloud infrastructure for adding extensions like an agent website, DocuSign, etc.

For years, franchises have supported their bottom line by selling advertising sponsorships to technology firms. Maybe this is changing into retailing technology.

In the brokerage firm space…

There are two companies that are highly focused on an app store type concept for brokers. Those companies are Inside Real Estate with KV Core, a technology firm that is not aligned with any franchise. Another is Moxiworks with MoxiCloud. These are more than just platforms with API integrations for data and single sign-on. They enable upsell to the agent or team of ancillary software from other providers that integrate with API and single sign-on.

A couple of companies to keep your eye on are Compass and Lone Wolf. Lone Wolf is owned by Vista, the fourth largest technology holding company in the world who has been focused on accounting and transaction processing in real estate. Compass has a big box of cash, an open mind, and they’ve hired the best technology team in the industry. You never know what kind of brilliance will come out of them.

Many brokers have a technology fee, but I am not familiar with any brokers who have a technology store. For large firms, this could be a solid source of revenue if SaaS rev shares are between 20% and 40%.

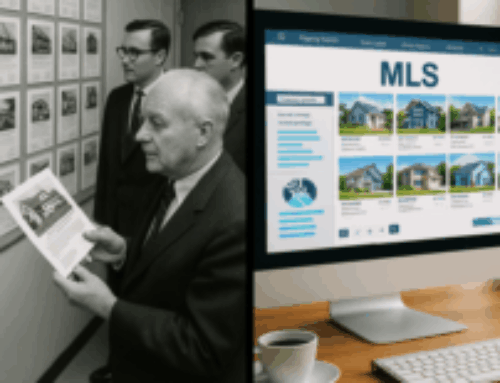

In the MLS space…

The first to market for MLSs is the Spark® Platform by FBS, an MLS vendor. This platform hosts apps that are powered by the Spark API for MLS data. They are integrated into the FlexMLS system so agents can easily access the application without leaving the MLS system. The Spark Platform and API is available to all of FBS’s 155 MLS customers, and FBS is just starting to launch a new Spark Datamart to streamline data licensing by developers. The Spark Datamart is available in 32 markets served by FBS.

CoreLogic announced that Showing Time and Voiceter have joined their Alliance Network. It is a similar concept to the FBS Spark Platform. Technology companies that are in the Alliance Network benefit from being integrated into CoreLogic in various ways. Sometimes this integration is in Matrix, sometimes this integration is into Clarity Single Sign-On Dashboard. Powering these integrations is Trestle, CoreLogic’s data hub developed to accommodate the RESO standards. About 13 companies are in the Alliance Network now. It’s growing pretty quickly.

We have not seen much from Black Knight or Rapattoni in this arena beyond single sign-on.

Again, reselling technology draws a revenue share of between 20% and 40% – which would really be significant and could even make MLS free!

In the Association space…

There is almost no effort to create an app store by the National Association of REALTORS®. They have a REALTOR® store, but it is mostly for buying reports, certifications, and their REALTOR Benefits® program. Perhaps the most advanced effort to develop an app store for REALTORS® has been advanced by a group of large Realtor® associations called RE Altitude. In aggregate, they open their vendor partners to 230,000 real estate agents. Some of these associations have developed premium levels of membership whereby they bundle a productivity suite for agents that the sell and support for an extra $100 to $250 per month per agent.

I bet that Houston, Miami, and San Diego could be looking at the growth of their premium service sales success and wondering when they make base MLS free as a tactic to expand.

In the portal space….

Zillow Group has not really done anything here, which is a surprise. They purchased some companies like DotLoop and Diverse Solutions (an IDX vendor) but did not really expand from there. They purchased Bridge Interactive to create a syndication platform and to have leverage on Upstream, but have not really expanded that either. To be clear, the sales and adoption of these Zillow products are significant, but they have not continued to roll up technology firms or launch new ancillary products.

Realtor.com has been enormously successful with their acquisition of Top Producer, and that has some premium add on products like lead management and market reports – pretty similar to the Realogy strategy of adding extensions. Again, not a lot of roll up activity or new product launches here recently, but steady adoption growth.

Homes.com has its Homes Connect product, which is like a swiss army knife for real estate technology that has a function for just about anything you could imagine.

What’s the future?

I really do not believe that anyone has established a beachhead here beyond having access to a lot of agent eyeballs. They all have the capability of data enablement with both MLS data and customer record data. That is super important. The beauty of an app is that once you authorize your data, it is a plug and play experience. Most of them also have some type of single sign-on. We all know that no agent can keep track of the dozens of passwords to access products today. SSO is a requirement.

All of these companies are challenged in depth of choice and in customization. Each of them has a piece of what an agent wants, but not the whole pie or different varieties of pie. Agents really want to build their own technology stack – some prefer Heinz Ketchup, others prefer Hunts.

Agents do not necessarily want a technology that is only available from a particular broker or franchise. Agents have been known to switch brokerages and franchises and do not want to start all over with new tech.

There is no Costco or Amazon of real estate technology today, but if 1 million agents are spending $350 per month on tech, I would bet that there will be one soon. My wager is that it will take an unaffiliated company to pull it off – like a Vista, Inside Real Estate, or Moxy; or maybe a consortium of associations like RE Altitude; a group of MLS vendors; a portal; or a media company like RE Technology or Inman. I did not mention title companies, but if you look at a company like Fidelity that owns Commissions Inc, SkySlope and other tech products could invade from left field.

Maybe our strategy at RE Technology of publishing articles about how to use technology in real estate was narrow thinking. It might be time to dust off the old RE Technology Success Store™ and get that rolling again.

Here is the original press release from CoreLogic:

Press Release

MAY 15, 2019

IRVINE, CALIF.

SHOWINGTIME AND VOICETER PRO JOIN CORELOGIC ALLIANCE NETWORK

CoreLogic® (NYSE: CLGX), a leading global property information, analytics and data-enabled solutions provider, today announced two new members of the Alliance Network: ShowingTime® and Voiceter Pro®. The Alliance Network is an assembly of recommended third-party solutions that are deeply integrated with Matrix™, the real estate industry’s leading multiple listing platform.

ShowingTime is a showing management and market statistics solution used by over 250 multiple listing organizations across North America. Matrix users can directly access ShowingTime to easily schedule property showings and visualize local housing trends with custom MarketStats reports.

“Joining the CoreLogic Alliance Network was an easy decision for us,” said Scott Woodard, CEO of ShowingTime. “We deliver a highly integrated experience for ShowingTime users who also use CoreLogic products, adding even more value to our showing services and market stats solutions.”

Voiceter Pro is a voice-driven home search service that works with Amazon Alexa and Google Assistant devices. With Voiceter Pro, CoreLogic Matrix users and their homebuyers can easily search for listings using the power of their voice.

“Over a billion people use Amazon Alexa and Google Assistant devices,” said Amy Gorce, principal of business development at CoreLogic. “The next generation of property search will be voice enabled, empowering real estate professionals and their clients to search for homes using the same voice technology they already use every day.”

“It’s exciting to watch the Alliance Network continue to grow,” added Chris Bennett, executive leader of Real Estate Solutions for CoreLogic. “Our clients look to us for technology that improves their subscribers’ lives. We are constantly researching and evaluating new solutions we think will complement our industry-leading platforms. We are thrilled to have ShowingTime and Voiceter Pro on board.”

About CoreLogic

CoreLogic (NYSE: CLGX), the leading provider of property insights and solutions, promotes a healthy housing market and thriving communities. Through its enhanced property data solutions, services and technologies, CoreLogic enables real estate professionals, financial institutions, insurance carriers, government agencies and other housing market participants to help millions of people find, acquire and protect their homes. For more information, please visit www.corelogic.com.

CORELOGIC, the CoreLogic logo and Matrix are trademarks of CoreLogic, Inc. and/or its subsidiaries. All other trademarks are the property of their respective owners.

In Canada, the trademarks MLS®, Multiple Listing Services® and the associated logos are owned by The Canadian Real Estate Association (CREA) and identify the quality of services provided by real estate professionals who are members of CREA. CoreLogic is not a member of CREA but is authorized to provide certain services to CREA’s members.

Media Contact

Alyson Austin

Corporate Communications

CoreLogic