Let me begin by saying that the remarks that follow do not apply to all MLSs. There are many that do an excellent job at servicing the data needs of brokers. The focus of this article is to talk about some of the common failures seen by WAV Group consultants trying to help brokers fix complex data problems.

Let me begin by saying that the remarks that follow do not apply to all MLSs. There are many that do an excellent job at servicing the data needs of brokers. The focus of this article is to talk about some of the common failures seen by WAV Group consultants trying to help brokers fix complex data problems.

There is a fundamental understanding of the MLS which has been lost. Although MLS systems provide excellent services through the MLS software, many are failing at providing data services to the brokers and agents to power the many applications that live outside the MLS system. This failure needs to be addressed across the industry.

At the heart of the failure is the resistance to adopt the most current version of RETS. The systems that power a brokerage probably will work fine with whatever RETS standard or FTP standard you offer if that brokerage is only in 1 MLS. If the brokerage belongs to more than 1 MLS, chaos ensues.

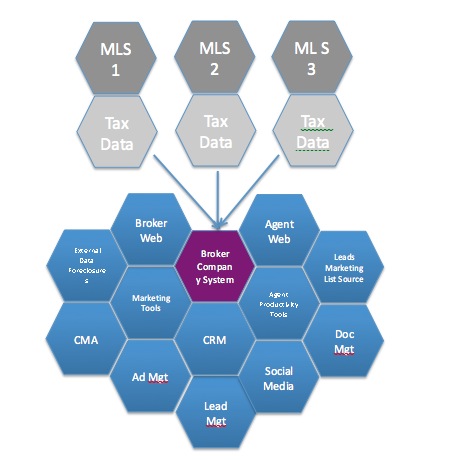

Enterprise brokerages will be defined by brokerages that participate in more than one MLS. Most enterprise brokerages have a laundry list of technology applications that rely on MLS data from a variety of technology vendors. The brokerage goal is to apply a layer of consumer, agent, and business services that rides on top of multiple MLS. The current broker technology ecosystem was outlined perfectly by WAV Group partner Michael Audet in a paper he authored called “The Shift in Real Estate Technology.”

You can review the webinar on this topic here, and download slides from the webinar.

You can download the whitepaper here.

This image shows the architecure of an enterprise brokerage.

At the heart of making all of this work is a persistant data, delivered using the RETS standard.

Technology consultant Matt Cohen of Clareity Consulting outlined the core problem facing MLSs with RETS adoption. It is not in the contract with the vendor! He writes “…new versions of RETS are always becoming available and each new version has capabilities that the MLS and its members can leverage. For example, RETS now has fairly robust capabilities allowing listings to be input via other front ends – for example broker systems, or forms software, and ensuring that these front ends follow the MLSs business rules. But most MLSs don’t offer their brokers this capability. Why? Because it’s not in the contract. When a new version of RETS become available, the vendor must be contractually obligated to provide it in a specific timeframe, and support the old one for a good amount of time afterward to allow for smooth third party developer transitions.” (https://www.realtown.com/mattcohen/blog/mls-contracts-and-rets)

If MLSs adopt the RETS standard and demand updates from their vendor – they will reduce technology costs to brokers by as much as 40 percent. Moreover, all of the systems that drive success in the brokerage will be improved with data quality across all systems.

In truth, there are probably more vendors who appreciate the inconsistent and erratic data schema variety from MLSs. Once you are big enough to have a data aggregation team that normalizes data – it becomes an enormous competitive advantage. Moreover, they can justify charging higher brokerage fees. The current rates for setting up an MLS feed are around $1500 per mls, plus anywhere from $150 to $175 per month for feed maintenance.

Set Up Fees: For most enterprise level brokerages, there are about 15 or more vendor applications. That is $1500 setup per feed x 15 vendors, or $22,000 per MLS for set up. Take the San Francisco bay area as an example. The enterprise brokerage belongs to 5 MLS – so the set up fees are north of $100,000.

Monthly Fees. $150 per month x 15 vendors equates to $2250 per month. Using the San Francisco Bay area as an example again – the enterprise brokerage with 5 MLSs would pay $11,250 per month or $135,000 per year.

JUST FOR DATA SERVICES. None of this pricing considers the cost of the application itself.

I imagine that many of the savvy readers of this article are thinking that this is the reason for MLS mergers and data sharing. You are correct! But using the Bay Area example again – It is not happening. They have a data share in place – but no broker can pull a feed from it with all Active, Pending, and Sold data – the fundamental information that is needed to power a CMA or a VOW.

If the MLSs and Vendors would simply agree to a data standard, MLS mergers and data sharing would be moot, with the exception of redundant data (listings entered into multiple MLSs causes duplicates). I will leave the issues of overlapping market disorder for another day. Those are easy to fix if a data standard could be adopted.

Here is how you can be part of the solution.

1. Join RESO – it does not matter if you are a broker or an MLS. You need to join the movement to create data standards and your input is needed. Here is the website.

2. To catch up on how enterprise brokerage are approaching their websites today – join this free webinar sponsored by RE Technology and Real Estate Digital. They are bringing in two expert panelists. One will cover the role of SEO in real estate, impact of Google’s Penguin Update. The other will talk about the principles of designing User Interfaces for enterprise broker websites. The webinar is Monday November 5th. Register here.

If you are a broker challenged by the complexities of multiple systems operating across multiple MLSs – call Victor Lund. I might be able to help you. 805-709-6696